Our trusted partners in progress…

Office No 9, 1st Floor, Bhoomi Tower, Opp ITM, Sector 4, Kharghar - 410 210

7303340500 / 9324344454 / 9322324252 / 9324058401

Our trusted partners in progress…

National Bulls is a franchisee of Progressive Share Brokers Pvt Ltd. National Bulls started stock broking business in November 2004. PSBPL has membership rights of NSE, BSE, MCX, NCDES and CDSL.

Office No 9, 1st Floor, Bhoomi Tower, Opp ITM, Sector 4, Kharghar - 410 210, Navi Mumbai, Maharashtra, INDIA.

National Bulls is complete Financial Solution Provider… whether it be equities, derivatives, mutual funds, commodities, currency, IPOs, Bonds, NCDs & Company FDs and Insurance…

At National Bulls, we have never wavered from our commitment to give each client the personal attention they deserve

NBIS is operational at same location and managed & operated by same initial startup team since day one……… for over 15 years

Equity Investment have an edge over simply saving money in your bank account. Investing in equity & financial derivatives markets helps to beat the inflation by delivering a higher rate of return, thus increasing the value of principal amount invested. Capital Gains and periodic dividend income is the revenue source from equity investments.

FUTURES n OPTIONS

We are franchise of Progressive Share Brokers Pvt. Ltd., Mumbai. We offer trading in Futures and Options of Index and Stock on the NSE. In FnO trading, one can buy/sell positions in index or stock(s) contracts having contract period of up to 3 months.

Trading in FUTURES is simple! If, during the course of the contract life, the price moves in your favour (i.e. rises in case you have a buy position or falls in case you have a sell position), you make a profit.

Presently only selected stocks, which meet the criteria on liquidity and volume, have been enabled for futures trading.

OPTIONS

An option is a contract, which gives the buyer the right to buy or sell shares at a specific price, on or before a specific date. For this, the buyer has to pay to the seller some money, which is called premium. There is no obligation on the buyer to complete the transaction if the price is not favorable to him.

To take the buy/sell position on index/stock options, you have to place certain % of order value as margin. With options trading, you can leverage on your trading limit by taking buy/sell positions much more than what you could have taken in cash segment.

The Buyer of a Call Option has the Right but not the Obligation to Purchase the Underlying Asset at the specified strike price by paying a premium whereas the Seller of the Call has the obligation of selling the Underlying Asset at the specified Strike price.

The Buyer of a Put Option has the Right but not the Obligation to Sell the Underlying Asset at the specified strike price by paying a premium whereas the Seller of the Put has the obligation of Buying the Underlying Asset at the specified Strike price.

By paying lesser amount of premium, you can create positions under OPTIONS and take advantage of more trading opportunities.

Currency Futures – An Assets Class

A market that attracts about $5.2 trillion in daily volume, recognised as world’s largest market, accessible globally 24 hours a day – that is exactly what the Currency and Forex market is made up of. The advantage of small margin requirements and lower entry barriers makes it an important part of a retail investor’s portfolio.

NBIS offers you a simple and convenient way to trade and hedge your currency risk in four pair of Currencies- Dollar, Euro, Pound and Japanese Yen against Indian Rupee.

By offering you the choice of trading in different asset class of Currencies we offer you the opportunity to diversify your portfolio.

The benefits of choosing NBIS for your Currency Trading are :

Few Advantages of Currency Derivatives are:

Mutual funds are ideal for investors who want to invest in equities but do not have sufficient time and expertise to pick winning stocks. Mutual fund investments give you the advantage of professional management, lower transaction costs, and diversification, liquidity and tax benefits.

National Bulls NBIS offer you a simple and convenient way to invest and manage your personal finance thru mutual funds with over 30 AMCs.

NBIS offers an efficient way to investing. NBIS has access to all the three MF platforms viz. BSEStAR MF, NSE MFII and MF Utility.

The benefits of choosing National Bulls for your Mutual Fund investment are :

Pick the investment that is right for you

Since the process of selecting the right mutual fund may feel complex and tedious, we have researched the funds and using certain criterion have created a choice of funds.

You may choose to invest in the choice of funds suggested by our experts or may build your own portfolio.

Mutual Fund Investing

We need to do one time form fill up for MFs. All subsequent transactions can be done online. Our online mobile app offers you facilities like viewing MF holdings, download reports (like capital gain report) making a lump sum investment, redemption, switches within same funds, setting up systematic investment plans etc.

One can start with as little as Rs.500 when you start a Systematic Investment Plan or Rs.5000 in case of lump sum investment.

Commodities as an asset class can be used to diversify portfolio for minimizing risks

Commodity trading brings a basket full of diverse avenues for investment, away from the traditional avenues of equity, bonds and real estate. Based on the historical data, adding commodities exposure to your existing portfolio helps you increase the returns while lowering the risk. Commodities have very little or negative correlation with other asset classes

Our empanelment with RenewBuy, Bajaj Allianz GIC, Future Generalli, CARE, Aditya Birla Insurance Brokers enables us to bring to you the entire range of insurance offerings for your personal and professional needs, with minimal paperwork and at the comfort of your home or office….. all these at competitive rates

General Insurance – General Insurance products cover Health, Home, Motor and Travel, and help protect your financial health unforeseen events strike close to home.

Life Insurance-insurance that pays out a sum of money either on the death of the insured person or after a set period:

Health Insurance : Health Insurance (popularly known as Mediclaim) offers protection in case of unexpected medical emergencies. In case of a sudden illness or accident, the health insurance policy takes care of the hospitalization, medical and other cost incurred.

You can avail of tax benefits for below mentioned products except Personal accident as per provisions of Section 80D of the Income Tax (Amendment) Act,1961.

Motor Insurance : A comprehensive package for your two-wheelers and four-wheelers, securing them against damage caused by natural and man-made calamities.

Access to over 2700 network garages across the country for cashless claims across India

Transfer your full benefits of No Claim Bonus when you shift your motor insurance policy from any another company to us

Car Insurance – A comprehensive policy for your four-wheeler; securing it against damage caused by natural and man-made calamities.

Two Wheeler Insurance – A Comprehensive package policy for your two wheeler, securing them against damage caused by natural and man-made calamities.

Travel Insurance – International Travel Insurance – Planning to visit abroad for a vacation or for business meetings? Worried about ill-health and non-medical emergencies? Just choose Single round trip travel insurance and travel worry-free.

International travel covers unexpected and emergency medical expenses incurred when a person is in overseas. In addition to the medical cover, there are non-medical covers like baggage loss / delay, trip cancellation / interruption / delay, passport loss, personal accident cover and financial emergency.

Pay on a per day basis for your overseas travel. No medical check-up upto 70 years, cashless hospitalization available worldwide

International Travel Insurance – Planning to visit abroad for a vacation or for business meetings? Worried about ill-health and non-medical emergencies? Just choose Single round trip travel insurance and travel worry-free.

Home Insurance –Home Insurance policy secures the structure as well as the contents of your home against natural and man-made disasters. Secure your most prized possession against terrorist activities by opting for a Terrorism Cover.

Protect your home with the comprehensive coverage. Get protection for structure and/or contents of your home. Avail 50% discount on buying a 10 years policy.

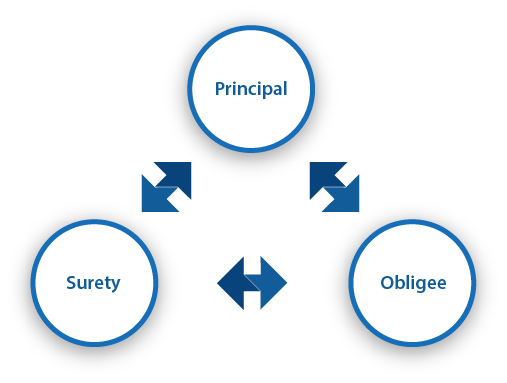

Bonds :

Bond refers to a security issued by a company, financial institution or government which offers regular or fixed payment of interest in return on the amount borrowed money for a certain period of time.

Thus by purchasing a bond, an investor loans money for a fixed period of time at a predetermined interest rate. While the interest is paid to the bond holder at regular intervals, the principal amount is repaid at a later date, known as the maturity date. While both bonds and stocks are securities, the principle difference between the two is that bond holders are lenders, while stockholders are the owners of the organization. Another difference is that bonds usually have a defined term, or maturity, after which the bond is redeemed, whereas stocks may be outstanding indefinitely.

Customer also has the option of recurring interest along with Principal i.e Cumulative Interest. Thus a bond is like a loan: the issuer is the borrower (debtor), the holder is the lender (creditor), and the coupon is the interest. Bonds provide the borrower with external funds to finance long-term investments, or, in the case of government bonds, to finance current expenditure. Bonds must be repaid at fixed intervals over a period of time.

Corporate Fixed Deposits :

We offer a range of Corporate Fixed Deposits varying in tenures, interest rates & institutions to suit your investment needs. The deposit schemes have been specially chosen from high-safety options to ensure that you enjoy the twin benefits of returns and protection.

Why opt for Corporate Fixed Deposits?

INITIAL PUBLIC OFFERING (IPO)

The primary market provides investors, opportunities to buy shares at a reasonable price upcoming IPOs of Indian companies. Additionally, retail investors also enjoy discounted rates while applying for Upcoming IPOs. Holding on to the shares also provides an opportunity to participate in the future success of these companies.

Exchange Traded Funds or ETFs are securities that are traded, like individual stocks, on an exchange. Unlike regular open-end mutual funds, ETFs can be bought and sold throughout the trading day like any stock.

Most ETFs charge lower annual expenses than many mutual funds. As with stocks, one must pay a brokerage to buy and sell ETF units.

You can buy and sell Gold, Index, Banking or International ETFs online through your trading account.

If you do not have an account with us, help us open your account and experience the world of online investing. Please call us for account opening.

Equity Investment have an edge over simply saving money in your bank account. Investing in equity & financial derivatives markets helps to beat the inflation by delivering a higher rate of return, thus increasing the value of principal amount invested. Capital Gains and periodic dividend income is the revenue source from equity investments.

Analysis of the market as a whole and its particular components (competitor, consumer, product, etc.)

Analysis of internal processes & procedures, staff activity evaluation, evaluation of technologies.

Successful experience of experts in structuring investment projects, developing and implementing.

Successful experience of experts in structuring investment projects, developing and implementing.

We are working in the format of an outsourcing project office. We assume operational coordination.

We are working in the format of an outsourcing project office. We assume operational coordination.

Integrating of innovation and public benefit into your workflows; ensuring strategic and sustainable.

We identify the mission, goals and strategic priorities of a business project or non-profit organization.

We are franchise of Progressive Share Brokers Pvt. Ltd., Mumbai. We offer trading in Futures and Options of Index and Stock on the NSE. In FnO trading, one can buy/sell positions in index or stock(s) contracts having contract period of up to 3 months.

Trading in FUTURES is simple! If, during the course of the contract life, the price moves in your favor (i.e. rises in case you have a buy position or falls in case you have a sell position), you make a profit.

Presently only selected stocks, which meet the criteria on liquidity and volume, have been enabled for futures trading.

An option is a contract, which gives the buyer the right to buy or sell shares at a specific price, on or before a specific date. For this, the buyer has to pay to the seller some money, which is called premium. There is no obligation on the buyer to complete the transaction if the price is not favorable to him.

To take the buy/sell position on index/stock options, you have to place certain % of order value as margin. With options trading, you can leverage on your trading limit by taking buy/sell positions much more than what you could have taken in cash segment.

The Buyer of a Call Option has the Right but not the Obligation to Purchase the Underlying Asset at the specified strike price by paying a premium whereas the Seller of the Call has the obligation of selling the Underlying Asset at the specified Strike price.

The Buyer of a Put Option has the Right but not the Obligation to Sell the Underlying Asset at the specified strike price by paying a premium whereas the Seller of the Put has the obligation of Buying the Underlying Asset at the specified Strike price.

By paying lesser amount of premium, you can create positions under OPTIONS and take advantage of more trading opportunities.

A market that attracts about $5.2 trillion in daily volume, recognised as world’s largest market, accessible globally 24 hours a day – that is exactly what the Currency and Forex market is made up of. The advantage of small margin requirements and lower entry barriers makes it an important part of a retail investor’s portfolio.

The benefits of choosing NBIS for your Currency Trading are:

NBIS offers you a simple and convenient way to trade and hedge your currency risk in four pair of Currencies- Dollar, Euro, Pound and Japanese Yen against Indian Rupee.

By offering you the choice of trading in different asset class of Currencies we offer you the opportunity to diversify your portfolio.

Few Advantages of Currency Derivatives are:

Mutual funds are ideal for investors who want to invest in equities but do not have sufficient time and expertise to pick winning stocks. Mutual fund investments give you the advantage of professional management, lower transaction costs, and diversification, liquidity and tax benefits.

National Bulls NBIS offer you a simple and convenient way to invest and manage your personal finance thru mutual funds with over 30 AMCs.

NBIS offers an efficient way to investing. NBIS has access to all the three MF platforms viz. BSEStAR MF, NSE MFII and MF Utility.

The benefits of choosing National Bulls for your Mutual Fund investment are :

Pick the investment that is right for you

Since the process of selecting the right mutual fund may feel complex and tedious, we have researched the funds and using certain criterion have created a choice of funds.

You may choose to invest in the choice of funds suggested by our experts or may build your own portfolio.

Mutual Fund Investing

We need to do one time form fill up for MFs. All subsequent transactions can be done online. Our online mobile app offers you facilities like viewing MF holdings, download reports (like capital gain report) making a lump sum investment, redemption, switches within same funds, setting up systematic investment plans etc.

One can start with as little as Rs.500 when you start a Systematic Investment Plan or Rs.5000 in case of lump sum investment.

Commodities as an asset class can be used to diversify portfolio for minimizing risks

Commodity trading brings a basket full of diverse avenues for investment, away from the traditional avenues of equity, bonds and real estate. Based on the historical data, adding commodities exposure to your existing portfolio helps you increase the returns while lowering the risk. Commodities have very little or negative correlation with other asset classes

Our empanelment with RenewBuy, Bajaj Allianz GIC, Future Generalli, CARE, Aditya Birla Insurance Brokers enables us to bring to you the entire range of insurance offerings for your personal and professional needs, with minimal paperwork and at the comfort of your home or office….. all these at competitive rates

General Insurance – General Insurance products cover Health, Home, Motor and Travel, and help protect your financial health unforeseen events strike close to home.

Life Insurance-insurance that pays out a sum of money either on the death of the insured person or after a set period:

Health Insurance : Health Insurance (popularly known as Mediclaim) offers protection in case of unexpected medical emergencies. In case of a sudden illness or accident, the health insurance policy takes care of the hospitalization, medical and other cost incurred.

You can avail of tax benefits for below mentioned products except Personal accident as per provisions of Section 80D of the Income Tax (Amendment) Act,1961.

Motor Insurance : A comprehensive package for your two-wheelers and four-wheelers, securing them against damage caused by natural and man-made calamities.

Access to over 2700 network garages across the country for cashless claims across India

Transfer your full benefits of No Claim Bonus when you shift your motor insurance policy from any another company to us

Car Insurance – A comprehensive policy for your four-wheeler; securing it against damage caused by natural and man-made calamities.

Two Wheeler Insurance – A Comprehensive package policy for your two wheeler, securing them against damage caused by natural and man-made calamities.

Travel Insurance – International Travel Insurance – Planning to visit abroad for a vacation or for business meetings? Worried about ill-health and non-medical emergencies? Just choose Single round trip travel insurance and travel worry-free.

International travel covers unexpected and emergency medical expenses incurred when a person is in overseas. In addition to the medical cover, there are non-medical covers like baggage loss / delay, trip cancellation / interruption / delay, passport loss, personal accident cover and financial emergency.

Pay on a per day basis for your overseas travel. No medical check-up upto 70 years, cashless hospitalization available worldwide

International Travel Insurance – Planning to visit abroad for a vacation or for business meetings? Worried about ill-health and non-medical emergencies? Just choose Single round trip travel insurance and travel worry-free.

Home Insurance –Home Insurance policy secures the structure as well as the contents of your home against natural and man-made disasters. Secure your most prized possession against terrorist activities by opting for a Terrorism Cover.

Protect your home with the comprehensive coverage. Get protection for structure and/or contents of your home. Avail 50% discount on buying a 10 years policy.

Bonds :

Bond refers to a security issued by a company, financial institution or government which offers regular or fixed payment of interest in return on the amount borrowed money for a certain period of time.

Thus by purchasing a bond, an investor loans money for a fixed period of time at a predetermined interest rate. While the interest is paid to the bond holder at regular intervals, the principal amount is repaid at a later date, known as the maturity date. While both bonds and stocks are securities, the principle difference between the two is that bond holders are lenders, while stockholders are the owners of the organization. Another difference is that bonds usually have a defined term, or maturity, after which the bond is redeemed, whereas stocks may be outstanding indefinitely.

Customer also has the option of recurring interest along with Principal i.e Cumulative Interest. Thus a bond is like a loan: the issuer is the borrower (debtor), the holder is the lender (creditor), and the coupon is the interest. Bonds provide the borrower with external funds to finance long-term investments, or, in the case of government bonds, to finance current expenditure. Bonds must be repaid at fixed intervals over a period of time.

Corporate Fixed Deposits :

We offer a range of Corporate Fixed Deposits varying in tenures, interest rates & institutions to suit your investment needs. The deposit schemes have been specially chosen from high-safety options to ensure that you enjoy the twin benefits of returns and protection.

Why opt for Corporate Fixed Deposits?

INITIAL PUBLIC OFFERING (IPO)

The primary market provides investors, opportunities to buy shares at a reasonable price upcoming IPOs of Indian companies. Additionally, retail investors also enjoy discounted rates while applying for Upcoming IPOs. Holding on to the shares also provides an opportunity to participate in the future success of these companies.

Exchange Traded Funds or ETFs are securities that are traded, like individual stocks, on an exchange. Unlike regular open-end mutual funds, ETFs can be bought and sold throughout the trading day like any stock.

Most ETFs charge lower annual expenses than many mutual funds. As with stocks, one must pay a brokerage to buy and sell ETF units.

You can buy and sell Gold, Index, Banking or International ETFs online through your trading account.

If you do not have an account with us, help us open your account and experience the world of online investing. Please call us for account opening.